Elliott Management: We Make This Recommendation To Our Friends: If You Own US Debt Sell It Now

http://www.zerohedge.com/news/elliott-m ... ell-it-nowEvery now and then we prefer to sit back and let some of the smartest money speak, especially when said smart money agrees with us. In this case, we hand the podium over to none other than Paul Singer's Elliott Management, which after starting with $1.3 million in 1977 was at $19.8 billion most recently. No expert networks, no high frequency trading, no "information arbitrage", no crony capitalism and pseudo monopolies of scale, and most certainly no bailouts: Singer did it all the old fashioned way: by picking undervalued assets and watching them appreciate. The timing is opportune because while Elliott has much to say about virtually everything in their latest 20 pages Q2 letter, it is the billionaire's sentiment vis-a-vis US Treasury debt that may be most critical, and may be the catalyst that resulted in today's abysmal 10 Year bond auction. To wit:

"long-term government debt of the U.S., U.K., Europe and Japan probably will be the worst-performing asset class over the next ten to twenty years. We make this recommendation to our friends: if you own such debt, sell it now. You’ve had a great ride, don’t press your luck. From here it is basically all risk, with very little reward." There is little that can be misinterpreted in the bolded statement. And while many have taken the other side of the Fed over the past 3 years, few have dared to stand against Paul Singer because if there is one person whose opinion matters above most, certainly above that of the Chairsatan, it is his.

More deep thoughts from Elliott:On QE and the nanny state:Printing money and overstaffing government offices may look like growth for a period of time, but it is actually the road to poverty, corruption and, ultimately, political upheaval.

On regulation:Opaque, overleveraged and vulnerable Financial Institutions which need to be propped up by the implicit or explicit guarantee of sovereigns does not make for a solid financial plumbing system for the global economy...this is a formula for power entrenchment, favoritism and shady deals behind closed doors.

On Dodd-Frank:Not only will it fail to make the system safer, but we believe it will likely be an actual accelerant of the next financial crisis. Dodd-Frank was supposed to “fix” the American financial system and end “too big to fail.” Unfortunately, the law, born in a political steamroller, does the exact opposite: it will be the accelerant of the next crisis. The 2008 crisis was episodic and took a while to get rolling. The next one could well be a black hole, and Dodd-Frank will bear responsibility for that.

On why Americans are angry:The government, lacking deep understanding of these firms, wants to pretend that their gigantic efforts (most notably Dodd-Frank) actually fixed the situation. But we believe that citizens are angry at what their guts tell them (correctly, basically) about the special treatment and riskiness of Financial Institutions.

On public data reporting:Decades ago, the balance sheets of the Financial Institutions contained most of the information you needed to know to understand their risks. Today the picture is profoundly different, predominantly due to the growth of leverage through derivatives....As a result, there is no major Financial Institution today whose financial statements provide a meaningful clue about the risks of the firm’s entire panoply of assets and liabilities including derivatives, nor how the firm’s performance, or even survival, will be affected by market movements in the future.

On leverage:Including derivatives, nearly all the world’s largest Financial Institutions are levered 50-100 times (not 10-20 as reflected on their balance sheets), so the exact composition of their derivatives books is essential to an understanding of their risks and stability....no hedge fund is remotely as leveraged as the Financial Institutions, and no hedge fund actually had to be rescued during the crisis.

On European banks:European institutions are in worse shape than before. Not only is their leverage (including derivatives) still at pre-crash levels, but they are choking on vast holdings of questionable sovereign debt which regulators more or less forced on them with lenient risk-weightings. These banks are stuffed with paper that private investors would not buy, as part of the “three-card Monte” shuffle that characterizes the European banking/sovereign system today.

On "peak fragility" in the bond and stock market:People are still buying bonds despite pitifully low yields because, well, they continue to go up in price, albeit in a self-reinforcing process goosed by central bank and momentum buying. When these forces exhaust themselves, the reversal could and should be swift and large. A decade ago, stocks were overpriced, but institutions who owned them were generally happy... Stocks looked predictable and safe at the very moment that they were maximally unsafe. That is where long-term bonds of these four currency blocs (euro, U.S., U.K. and Japan) now stand.

On "safety":“Safe haven” could be the two most expensive and painful words for investors in the financial lexicon this year.

On market sentiment:Global financial markets currently feel like they are in a period of calm before a storm, possibly centered on the European situation. The problem is that no one can foresee when the storm will make landfall, or how severe it will be.

On why Europe is making one wrong decision after another:Raising taxes to confiscatory levels (75% top rates are absurd and self-defeating), lowering already-too-low retirement ages, making it hard or impossible to fire people (which obviously discourages hiring them in the first place), increasing the scope of regulation and making it more complicated and subject to greater discretion by hostile, inadequately informed regulators, and making threatening noises at every turn about “the rich”, are the precise opposite of the actions and statements that policymakers should make to attract businesses and encourage expansions of existing businesses.

Nobody is forced to locate a business in Europe, and in fact capital flight today from several countries is already large and relentless.

On the future of Europe:Since all of the euro bloc surprises in the last couple of years have been negative, and since the answer to every question about the ultimate cost of preserving the euro is “more than you thought yesterday,” the metaphor of a slow-motion train wreck seems quite appropriate.

The overall situation is not going sideways or up. It is drifting down.

On Socialists - in this case in France, but applicable everywhere:The Socialists are unlikely to be terribly successful at preventing the destruction of jobs, but they may be all too effective, however unintentionally, at stifling job creation.

On tax policy:Dramatic increases in taxes and regulation, together with a repeatedly punitive tone, are understandably extrapolated by capitalists and investors as indicators of hostility toward business and profits. The societal loss from the business decisions occasioned by such signals is self-reinforcing. Businesspeople sitting on their hands leads to lower growth and more angry rhetoric and hostile actions by government.

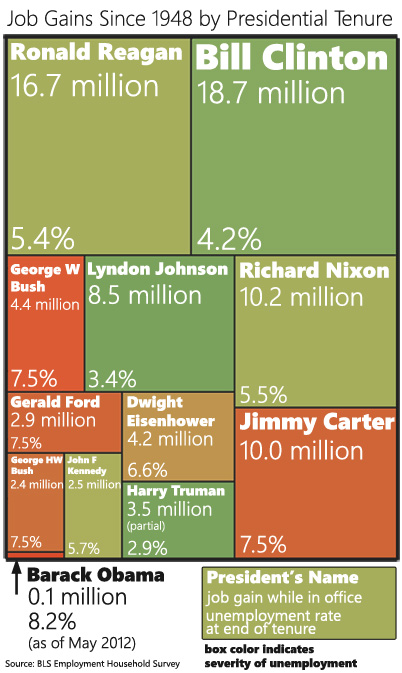

On the lack of job creation:Since the top 20% of taxpayers (which includes a great number of people making less than billions and even millions) pay the overwhelming bulk of taxes, this promise to raise taxes has not exactly generated enthusiasm or jobs.

On US (small) business uncertainty:Under ACA and the scheduled rise in overall federal income tax rates, one of the largest aggregate tax increases in American history is scheduled for five months from now. This is occurring at the same time that several strapped large states are also raising their top tax brackets.

On shifts in paradigms:Businessmen are inherently optimistic, typically always looking for reasons to do business, expand and innovate. Historical experience shows that when established perceptions are wrong, it can take a long time for contradictory data points to accumulate before such perceptions start to adjust and to cause alterations of behavior. However, at a certain moment, shifts in perceptions and trends could be abrupt, especially given modern tools of instant communication.

Today the hostility of the American and European governments to private enterprise, wealth and profits is used by those governments as vote-buying tactics. The impact on growth and jobs is already visible, and capital flight (already seemingly underway in France) may accelerate unless the policies, and tone, change.

On the US welfare state:If [Social Security, Medicare, Medicaid and government pensions] are not reformed, such entitlements simply cannot be paid as promised, regardless of the levels of future growth or taxes on “the rich” or anyone else. The numbers are just too big, the result of a form of corruption: politicians made big promises in exchange for votes, not worrying about whether the promises could be fulfilled.

On the US "recovery"Three and a half years after the bust, the massive spending, guarantees and money printing have left America with 8.2% unemployment (which vastly understates the actual level, since millions of people have simply left the workforce, while others have migrated from receiving unemployment benefits to getting long-term disability payments), sluggish growth, $5 trillion in additional federal debt, and $3 trillion of freshly-printed dollars on the Fed’s balance sheet. This is not a success. This is a national tragedy, in a society in which the world’s greatest engine of prosperity has historically been fueled by innovation, optimism, entrepreneurship, flexibility and opportunity.

On Congress handing over the decisionmaking process to the Fed:We believe that relying on monetary authorities to pick up the considerable slack in growth by printing money by the boatload is completely wrongheaded. It distorts both the price of money and the risks of holding long-term claims denominated in paper money, builds a future risk of large inflation, supports economic activity only in an oblique and unfair way, and creates something that is going to be very hard to unwind.

On the consequences of the printing money "alchemy":Somehow many policymakers and citizens have come to believe that money printing is some kind of magical process, that good things can be produced literally out of thin air, and that if leaders don’t create growth from obviously-needed changes in wrongheaded policies, then poof!... printing more money will solve it. This is pathetic.

The range of inevitable costs to societies practicing such alchemy is somewhere between “a lot” and “utterly catastrophic.” The damage is already becoming evident, particularly in the distortion between the rise in financial asset prices and the sluggishness of the real economy. When consumer prices soar across the board or there are other painful consequences, we wonder what excuses the blameworthy policymakers will make to deny their responsibility.

Finally, on what nobody wants to discuss, but could very easily be the final outcome:

A loss of confidence in paper money could result in searing and startling inflation, evaporating life savings and turning every stolid worker into a frantic speculator. If that were to occur, nobody could possibly say in hindsight that the conditions for such a sorry state of affairs were not in place.

The people who are telling us now that inflation is impossible because there is slack in the global economy, and that central banks can print trillions of dollars more without a significant risk of inflation, are the same folks who not only failed to predict the financial crisis, they did not even have a clue that a crisis of such kind was possible.

Indeed the "smartest money" is just that because it calls it how it is.

impressive , don't you think ?!

“The key insight of Adam Smith's Wealth of Nations is misleadingly simple: if an exchange between two parties is voluntary, it will not take place unless both believe they will benefit from it. Most economic fallacies derive from the neglect of this simple insight, from the tendency to assume that there is a fixed pie, that one party can gain only at the expense of another.”