President Barack Obama - Term 1 and 2 Thread

Moderator: Andrew

So is this all we are going to hear from here on out? First it was: "Obama can't fix it because Bush fucked it up so bad". Now it's: "Obama can't do it because....Oh hell, Romney couldn't have fixed it either". I'm getting tired of hearing these excuses.

-

The Sushi Hunter - Stereo LP

- Posts: 4881

- Joined: Sun Dec 02, 2007 11:54 am

- Location: Hidden Valley, Japan

The Sushi Hunter wrote:So is this all we are going to hear from here on out? First it was: "Obama can't fix it because Bush fucked it up so bad". Now it's: "Obama can't do it because....Oh hell, Romney couldn't have fixed it either". I'm getting tired of hearing these excuses.

Then do something else with your life besides whining like so many other conservatives and Republicans.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

Monker wrote:The Sushi Hunter wrote:So is this all we are going to hear from here on out? First it was: "Obama can't fix it because Bush fucked it up so bad". Now it's: "Obama can't do it because....Oh hell, Romney couldn't have fixed it either". I'm getting tired of hearing these excuses.

Then do something else with your life besides whining like so many other conservatives and Republicans.

LOL

-

The Sushi Hunter - Stereo LP

- Posts: 4881

- Joined: Sun Dec 02, 2007 11:54 am

- Location: Hidden Valley, Japan

The Sushi Hunter wrote:So is this all we are going to hear from here on out? First it was: "Obama can't fix it because Bush fucked it up so bad". Now it's: "Obama can't do it because....Oh hell, Romney couldn't have fixed it either". I'm getting tired of hearing these excuses.

You only hear the excuses because no one in our government has a solution to the problem especially the Obama Administration. Since Obama's reelection will still haven't gotten any real details of Obama's plans to fix the problem. Other then "tax the rich more". Obviously, anyone with common sense can see this is not the only thing that will cure the problem. The Obama Administration has presented nothing as to how and what spending cuts they will employ and no one seems to be asking what cuts they plan to do.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

The Sushi Hunter wrote:slucero wrote:It will fail.. but from the economics.. not the election. Romney would not have been able to do anything either. Faith in either party is a fools errand.. and if you ever believed Romney could change anythng, you are the chief fool.

Your comment is pathetic at best because how can you say he couldn't have fixed it when no one gave him a chance by electing him. Now had he been elected president and wasn't able to fix it during his term, yes then your comment would have been accurate.

No disrespect to Romney but I don't think that even he could fix the problem. Has nothing to do with his abilities or our bloated government. To me the problem seems to be with our system of currency which is a fiat currency system. A currency that is backed by nothing. Only by a government that says this piece of paper is worth X. We have stretched this system to it's limits and the government's plan of dumping more newly printed money into the system month after month is only going to crash the system to the point that that dollar will be worth nothing. Since the dollar is the world reserve currency you can see the impact this would have not only on the U.S. economy but the world economy as well. European and Asian countries have been looking at this problem to the extent that a year or two ago some of them got together to discuss the possibility of switching to something else as a world reserve currency. No one from the U.S. was invited to these talks.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

Boomchild wrote:The Sushi Hunter wrote:slucero wrote:It will fail.. but from the economics.. not the election. Romney would not have been able to do anything either. Faith in either party is a fools errand.. and if you ever believed Romney could change anythng, you are the chief fool.

Your comment is pathetic at best because how can you say he couldn't have fixed it when no one gave him a chance by electing him. Now had he been elected president and wasn't able to fix it during his term, yes then your comment would have been accurate.

No disrespect to Romney but I don't think that even he could fix the problem. Has nothing to do with his abilities or our bloated government. To me the problem seems to be with our system of currency which is a fiat currency system. A currency that is backed by nothing. Only by a government that says this piece of paper is worth X. We have stretched this system to it's limits and the government's plan of dumping more newly printed money into the system month after month is only going to crash the system to the point that that dollar will be worth nothing. Since the dollar is the world reserve currency you can see the impact this would have not only on the U.S. economy but the world economy as well. European and Asian countries have been looking at this problem to the extent that a year or two ago some of them got together to discuss the possibility of switching to something else as a world reserve currency. No one from the U.S. was invited to these talks.

The BRIC countries are already settling large transactions in other currencies (bypassing the dollar).

Muammar Gaddafi was likely killed because he was working towards creating a unified African currency, like the EU's Euro... except the African currency would have been backed by gold.... which would have instantly made the african currency more valuable than any other world currency (because all other currencies, tied to the dollar, are fiat (meaning only worth the paper they are printed on).

The Feds mandate of perpetual inflation in combination with their constant flooding of the economy with money via lowering the Fed rate has resulted in the Dollar has losing 95.67% of its purchasing power since 1913, the year the Fed began operating.

The Consumer Price Index (CPI) historical survey goes back to 1913, and is the governments own measure of inflation in the economy.

Here is the table: ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Viewing the table:

CPI in 1913: 10

CPI for today: 231.317

This means the cost of a basket of goods has gone up by 22.13X in the last 99 years.

To measure the loss of the dollar's value you simply divide 1/23.13 = .043 X 100 = 4.32%. In other words, the dollars has just 4.32% of it's value remaining and 95.67% of it's value has been lost.

and all along the way.. Republican and Democrats in the White House m and Congress have known this and done nothing about it..

History repeats itself..

Insanity: doing the same thing over and over again and expecting different results.

~Albert Einstein

-

slucero - Compact Disc

- Posts: 5444

- Joined: Thu Dec 21, 2006 1:17 pm

slucero wrote:Boomchild wrote:The Sushi Hunter wrote:slucero wrote:It will fail.. but from the economics.. not the election. Romney would not have been able to do anything either. Faith in either party is a fools errand.. and if you ever believed Romney could change anythng, you are the chief fool.

Your comment is pathetic at best because how can you say he couldn't have fixed it when no one gave him a chance by electing him. Now had he been elected president and wasn't able to fix it during his term, yes then your comment would have been accurate.

No disrespect to Romney but I don't think that even he could fix the problem. Has nothing to do with his abilities or our bloated government. To me the problem seems to be with our system of currency which is a fiat currency system. A currency that is backed by nothing. Only by a government that says this piece of paper is worth X. We have stretched this system to it's limits and the government's plan of dumping more newly printed money into the system month after month is only going to crash the system to the point that that dollar will be worth nothing. Since the dollar is the world reserve currency you can see the impact this would have not only on the U.S. economy but the world economy as well. European and Asian countries have been looking at this problem to the extent that a year or two ago some of them got together to discuss the possibility of switching to something else as a world reserve currency. No one from the U.S. was invited to these talks.

The BRIC countries are already settling large transactions in other currencies (bypassing the dollar).

Muammar Gaddafi was likely killed because he was working towards creating a unified African currency, like the EU's Euro... except the African currency would have been backed by gold.... which would have instantly made the african currency more valuable than any other world currency (because all other currencies, tied to the dollar, are fiat (meaning only worth the paper they are printed on).

The Feds mandate of perpetual inflation in combination with their constant flooding of the economy with money via lowering the Fed rate has resulted in the Dollar has losing 95.67% of its purchasing power since 1913, the year the Fed began operating.

The Consumer Price Index (CPI) historical survey goes back to 1913, and is the governments own measure of inflation in the economy.

Here is the table: ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Viewing the table:

CPI in 1913: 10

CPI for today: 231.317

This means the cost of a basket of goods has gone up by 22.13X in the last 99 years.

To measure the loss of the dollar's value you simply divide 1/23.13 = .043 X 100 = 4.32%. In other words, the dollars has just 4.32% of it's value remaining and 95.67% of it's value has been lost.

and all along the way.. Republican and Democrats in the White House m and Congress have known this and done nothing about it..

History repeats itself..

This is such a meaningless argument. The dollar is worth less. So what...people earn more. It's all a circular, meaningless, argument.

You would have more of a point if the CPI went up significantly more during the last four years...that inflation was inevitable. But, it isn't...it's not much more then the rise of the previous four years. So, all your 'facts' prove to me is the pressure for inflation is actually fairly low.

All of these predictions about this and that economic future are just bullshit...you can take any opinion and find numbers to back it up. People have been preaching "double dip recession" for YEARS now. Every year they are wrong. It's getting to be a bit ridiculous. I mean, really, what does Nostradomus say? It's really no different. It's like reading Perry fans expecting a new album next year...after a while even the most hardened fans gave up.

The bottom line is the economy is improving steadily...SLOWLY...but steadily. It would continue to do that no matter who is President. This really isn't much different then Reagan...except Obama took over a MUCH worse situation. Back then conservatives were claiming the longest peacetime economic expansion in history. I say it has NOTHING to do with policy but economic cycles - and you are going to see the EXACT SAME expansion under a non-supply side economic policy.

In the end, none of these charts and numbers matter. What matters is how people feel about their own situation - and if they can spend money. If they are willing to spend that worthless currency, and others are willing to accept it in exchange for goods or services, the economy will be better off and improve. THAT is what matters. Then credit loosens a bit...helping the economy. And, business feel more comfortable spending money as well...as in hiring more employees.

The issues that we all SHOULD HAVE learned is credit. Giving away bad credit to consumers DESTROYS the economy. Consumers ASKING for credit they KNOW they can't afford ALSO destroys the economy. And, coming up with tricks to try to transfer the credit to others does NOTHING but pass the problem on to someone else...and makes a bad situation even worse.

Those are the lessons to be learned from four years ago...not Democrat or Republican or conservative or liberal...but common sense in dealing with consumer borrowing.

And, yes, I know there are still a lot of foreclosures and bad debt hidden by accounting tricks. I'm just pointing to the elephant in the room. Everything else is just whiny mice wanting attention.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

Monker wrote:

This is such a meaningless argument. The dollar is worth less. So what...people earn more. It's all a circular, meaningless, argument.

You would have more of a point if the CPI went up significantly more during the last four years...that inflation was inevitable. But, it isn't...it's not much more then the rise of the previous four years. So, all your 'facts' prove to me is the pressure for inflation is actually fairly low.

All of these predictions about this and that economic future are just bullshit...you can take any opinion and find numbers to back it up. People have been preaching "double dip recession" for YEARS now. Every year they are wrong. It's getting to be a bit ridiculous. I mean, really, what does Nostradomus say? It's really no different. It's like reading Perry fans expecting a new album next year...after a while even the most hardened fans gave up.

The bottom line is the economy is improving steadily...SLOWLY...but steadily. It would continue to do that no matter who is President. This really isn't much different then Reagan...except Obama took over a MUCH worse situation. Back then conservatives were claiming the longest peacetime economic expansion in history. I say it has NOTHING to do with policy but economic cycles - and you are going to see the EXACT SAME expansion under a non-supply side economic policy.

In the end, none of these charts and numbers matter. What matters is how people feel about their own situation - and if they can spend money. If they are willing to spend that worthless currency, and others are willing to accept it in exchange for goods or services, the economy will be better off and improve. THAT is what matters. Then credit loosens a bit...helping the economy. And, business feel more comfortable spending money as well...as in hiring more employees.

The issues that we all SHOULD HAVE learned is credit. Giving away bad credit to consumers DESTROYS the economy. Consumers ASKING for credit they KNOW they can't afford ALSO destroys the economy. And, coming up with tricks to try to transfer the credit to others does NOTHING but pass the problem on to someone else...and makes a bad situation even worse.

Those are the lessons to be learned from four years ago...not Democrat or Republican or conservative or liberal...but common sense in dealing with consumer borrowing.

And, yes, I know there are still a lot of foreclosures and bad debt hidden by accounting tricks. I'm just pointing to the elephant in the room. Everything else is just whiny mice wanting attention.

Bernanke is on record stating 2% inflation is consistent with the Fed mandate.... and the effect of that - a continuous, Fed mandated 2% inflation is cumulative on prices... and is inversely destructive to purchasing power. It's commonly accepted that wages have not kept up with inflation, so it stands to reason that the rise in CPI vs. wages is only eroding purchasing power. One need only go to the grocery store or gas station to see that. Its in the 5lb bag of sugar that is now 4lbs and has still risen in price 25%, or that box of cereal that was 28 oz that is now 22 oz, and has still risen in price.... Producers are making up and hiding part of price inflation the adjusted quantity if their products. You simply have to look for it. If one can see that on Main Street, then a reasonable person would also question the veracity of the CPI.

If one uses the 1990 BEA calculation (the blue line) for CPI it looks like this :

When taking that 1990 adjusted CPI and using it to calculate GDP, GDP looks like this (the blue line):

Assuming the above two are true, then the only way CPI and wages could be not be "rising" is if the calculation methodology for CPI has been changed... which we already know occurred in 1990. Wages consistently rising during a period of declining GDP would not be normal, so it stands to reason that real wages are indeed falling, and against a rising CPI that means lost purchasing power, and a declining standard of living.

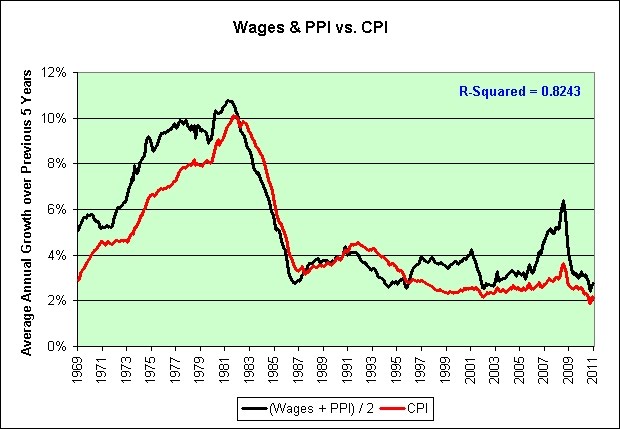

Below is a chart of Wages & PPI vs. CPI

Notice the drop in 1990, when the calculation methodology changed.

I do agree consumer confidence is a big deal, after all Consumer Spending is 70% of GDP... but that confidence comes from having additional income via wage growth and price stability, neither of which appear to be happening, especially when one takes a longer view.

Insanity: doing the same thing over and over again and expecting different results.

~Albert Einstein

-

slucero - Compact Disc

- Posts: 5444

- Joined: Thu Dec 21, 2006 1:17 pm

slucero wrote:I do agree consumer confidence is a big deal, after all Consumer Spending is 70% of GDP... but that confidence comes from having additional income via wage growth and price stability, neither of which appear to be happening, especially when one takes a longer view.

Well, when I look at those charts, what I see is two lines mimicking each other tic for tic. In general, the market keeps the two in check.

But, in the real word...away from the charts and graphs and numbers and calculations and guesses...people spend money depending on how they feel about the hear and now. Like your buddy Einstein would say, time is an illusion...people don't look back ten years ago and remember how their finances were and compare that to today and then decide if they want to buy a car or house, or whatever. They look at the hear and now and make that decision. And, if they can't afford a bigger, more expensive car or house, they spend less money and buy something smaller...and the market will drive the prices down.

Ah, whatever...I guess it doesn't matter. I think in 4yrs we'll be back to where we were when W. took over. Which probably means whoever comes after Obama will inherit an economy primed for an excuse for a recession. We'll see.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

Monker wrote:slucero wrote:I do agree consumer confidence is a big deal, after all Consumer Spending is 70% of GDP... but that confidence comes from having additional income via wage growth and price stability, neither of which appear to be happening, especially when one takes a longer view.

Well, when I look at those charts, what I see is two lines mimicking each other tic for tic. In general, the market keeps the two in check.

But, in the real word...away from the charts and graphs and numbers and calculations and guesses...people spend money depending on how they feel about the hear and now. Like your buddy Einstein would say, time is an illusion...people don't look back ten years ago and remember how their finances were and compare that to today and then decide if they want to buy a car or house, or whatever. They look at the hear and now and make that decision. And, if they can't afford a bigger, more expensive car or house, they spend less money and buy something smaller...and the market will drive the prices down.

Ah, whatever...I guess it doesn't matter. I think in 4yrs we'll be back to where we were when W. took over. Which probably means whoever comes after Obama will inherit an economy primed for an excuse for a recession. We'll see.

Goosing consumer confidence used to be easy for the Fed, especially easy considering the consumer is largely not interested in the fundamental mechanics that make up a real world healthy economy. All the Fed had to do was drop their lending rate, money would be cheap and easy, banks would lower rates, monetary velocity would increase, the DOW would rise nominally, and the consumer would "feel good" and go borrow and spend. The consumer response to Fed stimulus is almost Pavlovian. So the Fed continued to lower the rate (people kept borrowing and spending) until it it no longer worked any more. It is why the Fed lending rate is now parked at 0%, and they have had to resort to other means (which aren't working). Absent the heavy Fed subsidization via:

- 3 rounds of QE, POMO, and direct purchase of bonds,

- and the recent Fed announcement that it will QE indefinitely, even directly purchase assets. Something the Fed has never done.

It is also a good case for why employment is still stagnant, because business owners still do not see the very thing they need to grow and hire - demand. Business owners see this lack of demand, in concert with enough stimulus that should have the market rising like a rocket, especially when compared to the low Fed lending rate fueled 90's internet boom. This can only indicate consumers are not spending, which can only mean confidence is not high, and likely driven by a loss in purchasing power (via wage or job loss) and/or price inflation.

Yet here we are with a 0% interest Fed rate, orders of magnitude stimuli (which is also now debt, as that money is not "free") applied to the economy, dwarfing the ZIRP Fed 90's stimulus which exploded the economy... and we're mired in 2% GDP and employment stagnation, all which is called "slow, steady growth"? So what is different? What are clueless consumers not taking into account when seeing official reported numbers?

We know the BLS measure of long-term discouraged workers was defined out of official existence in 1994.

We know the BEA measure of inflation was changed in 1990.

When applying the previous measurement methods:

- Unemployment is likely 20% or greater.

(BLS estimate of U-6 unemployment, which includes short-term discouraged workers + previously defined out of official existence in 1994 long-term discouraged workers.) - GDP is sub 2% (and has been since the middle of 2011)

One could construe and question the way things are measured (and reported).

Insanity: doing the same thing over and over again and expecting different results.

~Albert Einstein

-

slucero - Compact Disc

- Posts: 5444

- Joined: Thu Dec 21, 2006 1:17 pm

Monker wrote:slucero wrote:I do agree consumer confidence is a big deal, after all Consumer Spending is 70% of GDP... but that confidence comes from having additional income via wage growth and price stability, neither of which appear to be happening, especially when one takes a longer view.

Well, when I look at those charts, what I see is two lines mimicking each other tic for tic. In general, the market keeps the two in check.

But, in the real word...away from the charts and graphs and numbers and calculations and guesses...people spend money depending on how they feel about the hear and now. Like your buddy Einstein would say, time is an illusion...people don't look back ten years ago and remember how their finances were and compare that to today and then decide if they want to buy a car or house, or whatever. They look at the hear and now and make that decision. And, if they can't afford a bigger, more expensive car or house, they spend less money and buy something smaller...and the market will drive the prices down.

Ah, whatever...I guess it doesn't matter. I think in 4yrs we'll be back to where we were when W. took over. Which probably means whoever comes after Obama will inherit an economy primed for an excuse for a recession. We'll see.

Goosing the confidence of a consumer who is largely not interested in the fundamental mechanics that make up a real world healthy economy used to be easy for the Fed, all they had to do was drop their lending rate, money would be cheap and easy, banks would lower rates, monetary velocity would increase, the DOW would rise nominally, and the consumer would "feel good" and go borrow and spend. So the Fed continued to lower the rate (people kept borrowing and spending) until it it no longer worked any more.

It is why the Fed lending rate is now parked at 0%, and they have had to resort to other means (which aren't working). Absent the heavy Fed subsidization via:

- 3 rounds of QE, POMO, and direct purchase of bonds,

- and the recent Fed announcement that it will QE indefinitely, even directly purchase assets. Something the Fed has never done.

It is also a good case for why employment is still stagnant, because business owners still do not see the very thing they need to grow and hire - demand. Business owners see this lack of demand, in concert with enough stimulus that should have the market rising like a rocket, especially when compared to the low Fed lending rate fueled 90's internet boom. This can only indicate consumers are not spending, which can only mean confidence is not high, and likely driven by a loss in purchasing power (via wage or job loss) and/or price inflation.

Yet here we are with a 0% interest Fed rate, orders of magnitude stimuli (which is also now debt, as that money is not "free") applied to the economy, dwarfing the ZIRP Fed 90's stimulus which exploded the economy... and we're mired in 2% GDP and employment stagnation, all which is called "slow, steady growth"? Creating the illusion of economic growth is easy if you can print money. It’s a prank you can play on an entire country. Cut the value of the currency in half and the economy’s size will appear to double, or at least tread water, which is what we currently are told is happening. The proof is in the U.S. economy as a whole when compared to the rest of the world. According to the World Bank, the U.S. share of worldwide economic activity went from 31.8% in 2001, to 21.6% by 2011, a 32% drop. That is not growth by any measure, and if you aren't growing, you’re in recession (whether you know it or not).

So what is different? What are clueless, uninterested consumers not taking into account when seeing official reported numbers that make them "feel good"?

We know the BLS measure of long-term discouraged workers was defined out of official existence in 1994.

We know the BEA measure of inflation was changed in 1990.

When applying the previous measurement methods:

- Unemployment is likely 20% or greater.

(BLS estimate of U-6 unemployment, which includes short-term discouraged workers + previously defined out of official existence in 1994 long-term discouraged workers.) - GDP is sub 2% (and has been since the middle of 2011)

One could construe what is "different" is the way things are measured (and reported), and if that is the case.. these numbers are nothing to "feel good" about.

Insanity: doing the same thing over and over again and expecting different results.

~Albert Einstein

-

slucero - Compact Disc

- Posts: 5444

- Joined: Thu Dec 21, 2006 1:17 pm

Monker wrote:Why in the world would anybody want to pay that kind of money for a gas gussling monster vehicle.

Try "guzzling".

My blog = Dave's Dominion

-

conversationpc - Super Audio CD

- Posts: 17830

- Joined: Wed Jun 21, 2006 5:53 am

- Location: Slightly south of sanity...

To some, these SUV's are a status symbol. The Latino's love them because they are vessels large enough to fit the entire family.

Neither group cares if it's good on gas or not.

Here's another vehicle used as a status symbol for this time of year:

White women are a status symbol too:

Don't you just love this time of the year.....

Neither group cares if it's good on gas or not.

Here's another vehicle used as a status symbol for this time of year:

White women are a status symbol too:

Don't you just love this time of the year.....

-

The Sushi Hunter - Stereo LP

- Posts: 4881

- Joined: Sun Dec 02, 2007 11:54 am

- Location: Hidden Valley, Japan

Fact Finder wrote:Surprise: New insurance fee in health overhaul law

December 10, 2012 2:47 PM ET

http://money.msn.com/health-and-life-in ... d=15884956

WASHINGTON (AP) - Your medical plan is facing an unexpected expense, so you probably are, too. It's a new, $63-per-head fee to cushion the cost of covering people with pre-existing conditions under President Barack Obama's health care overhaul.

The charge, buried in a recent regulation, works out to tens of millions of dollars for the largest companies, employers say. Most of that is likely to be passed on to workers.

Employee benefits lawyer Chantel Sheaks calls it a "sleeper issue" with significant financial consequences, particularly for large employers.

"Especially at a time when we are facing economic uncertainty, (companies will) be hit with a multi-million dollar assessment without getting anything back for it," said Sheaks, a principal at Buck Consultants, a Xerox subsidiary.

Based on figures provided in the regulation, employer and individual health plans covering an estimated 190 million Americans could owe the per-person fee.

The Obama administration says it is a temporary assessment levied for three years starting in 2014, designed to raise $25 billion. It starts at $63 and then declines.

Most of the money will go into a fund administered by the Health and Human Services Department. It will be used to cushion health insurance companies from the initial hard-to-predict costs of covering uninsured people with medical problems. Under the law, insurers will be forbidden from turning away the sick as of Jan. 1, 2014.

The program "is intended to help millions of Americans purchase affordable health insurance, reduce unreimbursed usage of hospital and other medical facilities by the uninsured and thereby lower medical expenses and premiums for all," the Obama administration says in the regulation. An accompanying media fact sheet issued Nov. 30 referred to "contributions" without detailing the total cost and scope of the program.

Of the total pot, $5 billion will go directly to the U.S. Treasury, apparently to offset the cost of shoring up employer-sponsored coverage for early retirees.

The $25 billion fee is part of a bigger package of taxes and fees to finance Obama's expansion of coverage to the uninsured. It all comes to about $700 billion over 10 years, and includes higher Medicare taxes effective this Jan. 1 on individuals making more than $200,000 per year or couples making more than $250,000. People above those threshold amounts also face an additional 3.8 percent tax on their investment income.

But the insurance fee had been overlooked as employers focused on other costs in the law, including fines for medium and large firms that don't provide coverage.

"This kind of came out of the blue and was a surprisingly large amount," said Gretchen Young, senior vice president for health policy at the ERISA Industry Committee, a group that represents large employers on benefits issues.

Word started getting out in the spring, said Young, but hard cost estimates surfaced only recently with the new regulation. It set the per capita rate at $5.25 per month, which works out to $63 a year.

I'm sure this won't be the last "unexpected expense" that will come out of Obamacare either.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

-

The Sushi Hunter - Stereo LP

- Posts: 4881

- Joined: Sun Dec 02, 2007 11:54 am

- Location: Hidden Valley, Japan

jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

-

The Sushi Hunter - Stereo LP

- Posts: 4881

- Joined: Sun Dec 02, 2007 11:54 am

- Location: Hidden Valley, Japan

Fact Finder wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

Reducing the deficit by only $400 Billion is to laugh out loud Monker.And the $1.6 Trillion he wants to confiscate from the rich will run this country for about what, 6 days? BTW, Monker, whatever happened to Obamas Campaign proposal of raising taxes by $800 Billion, suddenely he's re-elected and that number magically doubles? As I said, this cocksucker will steal your hat and then help ya look for it.

As compared to the last three Republican Presidents who believed that lowering taxes would somehow balance everything out...and instead did nothing but INCREASE the deficit. I'll take the specifics rather then the magical bullshit you represent.

As far as the 'rich' go, as i have said - taxes are at historic lows. Tax everybody over $500,000 at %30, no deduction... and count capital gains as income and tax it as such. That seems fair to me. If they don't like it, they can move to Mexico...or Texas, if they secede.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

Monker wrote:Fact Finder wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

Reducing the deficit by only $400 Billion is to laugh out loud Monker.And the $1.6 Trillion he wants to confiscate from the rich will run this country for about what, 6 days? BTW, Monker, whatever happened to Obamas Campaign proposal of raising taxes by $800 Billion, suddenely he's re-elected and that number magically doubles? As I said, this cocksucker will steal your hat and then help ya look for it.

As compared to the last three Republican Presidents who believed that lowering taxes would somehow balance everything out...and instead did nothing but INCREASE the deficit. I'll take the specifics rather then the magical bullshit you represent.

As far as the 'rich' go, as i have said - taxes are at historic lows. Tax everybody over $500,000 at %30, no deduction... and count capital gains as income and tax it as such. That seems fair to me. If they don't like it, they can move to Mexico...or Texas, if they secede.

That's because they didn't not reduce the government spending enough as well. The problem is that no matter if it has been a Democrat or Republican in office the past several years they all spent and expanded government too much. Give a politician money and you can be sure they will spend every penny of it they can.

Last edited by Boomchild on Wed Dec 12, 2012 1:36 pm, edited 1 time in total.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

The Sushi Hunter wrote:And with who's money and at who's expense?

Everyone's. When Obama was just a senator he said in an interview that he was a believer in a system of redistribution. Since then he has never said that he has changed his opinion. So he is just working slowly at implementing this type of system. Don't be fooled, he wants more money put into the system from every working American.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

So, Obama won't call for raising the debt limit again then, right? After all, he collecting taxes to cover it all. My bet is that before we get through the first quarter of 2103 he will be insisting that it be raised. After all, he's made statements that he wants direct control over the debt limit without going to Congress for approval.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

Boomchild wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

So, Obama won't call for raising the debt limit again then, right? After all, he collecting taxes to cover it all. My bet is that before we get through the first quarter of 2103 he will be insisting that it be raised. After all, he's made statements that he wants direct control over the debt limit without going to Congress for approval.

Isn't that how dictatorships work?

Why not just fire congress and reduce the goverment payroll then? Doesn't make sense to pay for something so ineffective.

-

steveo777 - MP3

- Posts: 11311

- Joined: Fri Feb 13, 2009 12:15 pm

- Location: Citrus Heights, Ca

Boomchild wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

So, Obama won't call for raising the debt limit again then, right? After all, he collecting taxes to cover it all. My bet is that before we get through the first quarter of 2103 he will be insisting that it be raised. After all, he's made statements that he wants direct control over the debt limit without going to Congress for approval.

Wow, how ignorant. There is a difference between our national debt and the budget deficit. Two somewhat related, but different topics.

Raising the debt limit allows for payment of debt that has already incurred. Whether you like it or not, it has to be done regardless of what budget is passed. Basically, it's become a political tool for one side or the other to get what they want/don't want in the budget, "if you don't cut Boom Boom's taxes then the piss-our pants party are not going to vote for raising the debt ceiling." So, remove the politics from it and let the President raise it...because it's going to be done anyway - no real choice.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

Fact Finder wrote:Monker wrote:Fact Finder wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

Reducing the deficit by only $400 Billion is to laugh out loud Monker.And the $1.6 Trillion he wants to confiscate from the rich will run this country for about what, 6 days? BTW, Monker, whatever happened to Obamas Campaign proposal of raising taxes by $800 Billion, suddenely he's re-elected and that number magically doubles? As I said, this cocksucker will steal your hat and then help ya look for it.

As compared to the last three Republican Presidents who believed that lowering taxes would somehow balance everything out...and instead did nothing but INCREASE the deficit. I'll take the specifics rather then the magical bullshit you represent.

As far as the 'rich' go, as i have said - taxes are at historic lows. Tax everybody over $500,000 at %30, no deduction... and count capital gains as income and tax it as such. That seems fair to me. If they don't like it, they can move to Mexico...or Texas, if they secede.

Well, every so-called RICH man that I know would take your proposal yesterday and forever, but alas, that's not the way it is. But we can dream.

Yeah, sure, every "Romney" in the world is going to love taking his taxes from an effective rate of %15 and doubling it to %30. Riiiiiight.

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

steveo777 wrote:Boomchild wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

So, Obama won't call for raising the debt limit again then, right? After all, he collecting taxes to cover it all. My bet is that before we get through the first quarter of 2103 he will be insisting that it be raised. After all, he's made statements that he wants direct control over the debt limit without going to Congress for approval.

Isn't that how dictatorships work?

Why not just fire congress and reduce the goverment payroll then? Doesn't make sense to pay for something so ineffective.

Actually, no other country in the world operates with a "debt ceiling". It is effectively - irrelevant.

Just use common sense for a moment. Congress somehow passes a budget and Obama signs it. Then we find in the middle of the year that we hit the debt ceiling. The options are to not pay our bills and operating under some type of limited government...essentially throwing the country into a depression. Or, raise the debt ceiling.

Are people in this forum so naive that they believe the political CRAP that the debt ceiling has any real function at all?

- Monker

- MP3

- Posts: 12704

- Joined: Fri Sep 20, 2002 12:40 pm

Monker wrote:Boomchild wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

So, Obama won't call for raising the debt limit again then, right? After all, he collecting taxes to cover it all. My bet is that before we get through the first quarter of 2103 he will be insisting that it be raised. After all, he's made statements that he wants direct control over the debt limit without going to Congress for approval.

Wow, how ignorant. There is a difference between our national debt and the budget deficit. Two somewhat related, but different topics.

Raising the debt limit allows for payment of debt that has already incurred. Whether you like it or not, it has to be done regardless of what budget is passed. Basically, it's become a political tool for one side or the other to get what they want/don't want in the budget, "if you don't cut Boom Boom's taxes then the piss-our pants party are not going to vote for raising the debt ceiling." So, remove the politics from it and let the President raise it...because it's going to be done anyway - no real choice.

Your mean like the 1.6 trillion Obama spent in his first term? It's directly related to both the national debt and current budgets. Rising the debt limit allows the government to borrow more money. Things would be all well and good if that newly borrowed money only gets put towards the national debt incurred, but it doesn't. They use it for new spending. It's ignorant to believe otherwise. It's seems any objection to Obama's actions is a "political tool". Too Funny.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

Monker wrote:steveo777 wrote:Boomchild wrote:Monker wrote:jThe Sushi Hunter wrote:Fact Finder wrote:This cocksucker will steal your hat and then help ya look for it.

75 Percent of Obama's Proposed Tax Hikes to Go Toward New Spending

http://www.weeklystandard.com/blogs/75- ... 66067.html

Sounds about right. Am I surprised? Nope....didn't vote for him.

So, he is actually paying for everything and reducing the deficit.

Conservatives should be happy...but, they never will be.

So, Obama won't call for raising the debt limit again then, right? After all, he collecting taxes to cover it all. My bet is that before we get through the first quarter of 2103 he will be insisting that it be raised. After all, he's made statements that he wants direct control over the debt limit without going to Congress for approval.

Isn't that how dictatorships work?

Why not just fire congress and reduce the goverment payroll then? Doesn't make sense to pay for something so ineffective.

Actually, no other country in the world operates with a "debt ceiling". It is effectively - irrelevant.

Just use common sense for a moment. Congress somehow passes a budget and Obama signs it. Then we find in the middle of the year that we hit the debt ceiling. The options are to not pay our bills and operating under some type of limited government...essentially throwing the country into a depression. Or, raise the debt ceiling.

Are people in this forum so naive that they believe the political CRAP that the debt ceiling has any real function at all?

I think it's more naive to think that Obama is raising enough taxes to cover all the spending he has planned. Let's see, the first number he gave was 800 billion which has now grown to 1 trillion in new spending and I am sure that's not the last revision. He wants Congress to approve raising taxes on the wealthy and then he'll discuss spending cuts. I think Obama is naive to think that some people in Congress are as dumb as some of the people that voted for him.

-

Boomchild - Compact Disc

- Posts: 7129

- Joined: Tue May 11, 2010 6:10 pm

- Location: Pennsylvania

Return to Snowmobiles For The Sahara

Who is online

Users browsing this forum: No registered users and 6 guests