Boomchild wrote:Monker wrote:A Ponzi scheme? That is just way exaggerating. I

Great, now ask the federal government to show you that the money is actually there instead of a bunch of IOUs. The only thing that keeps it from being deemed as a Ponzi scheme is that it is our government operating it and they just so happen to own the presses that prints our money.

There is no money in the SS Trust Fund. Not "a little", not "some", literally $0.

When your SS tax is taken out of your paycheck, most goes out immediately to pay current retirees, and the rest (say, $100) goes to the U.S. Treasury - and is spent on roads, bridges, defense, public television, whatever - spent, gone. In return for that $100, the Treasury sends the Social Security Administration an IOU for $100. These are called "special issue bonds" or SIBs.

The trust is "funded" so long as there are buyers for those SIB's.

Demographically, we are very much like Japan in that have a lower replacement worker ratio (the number of workers supporting those retirees under SSI) than ever before, with more people drawing off the system than there are supporting it. U.S. government tax receipts are down, and will continue to decline not only to due to the obvoius economic reasons, but also the not-often-thought-about demographic reasons outlined above.

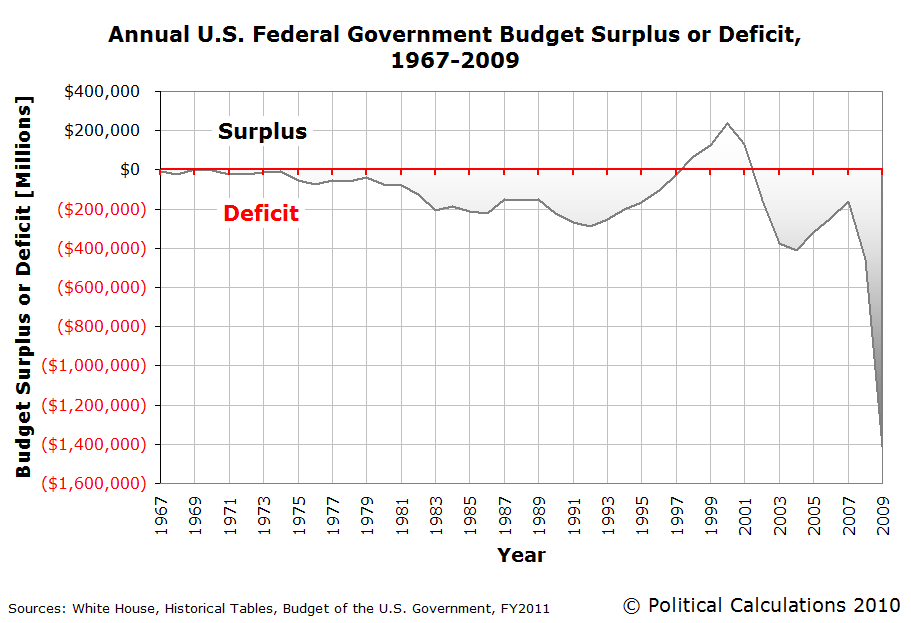

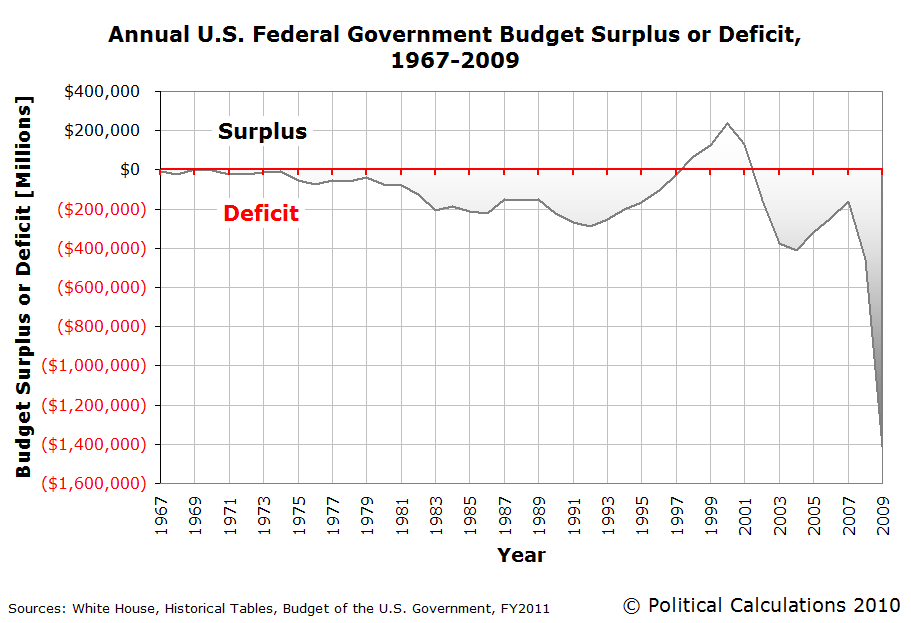

Our government has also been issuing debt (deficit spending) since 1973 just to fund "other" programs, and that debt issuance went parabolically negative 2007. (see below)

Currently the government collects more than it needs to pay SSI benefits, but by 2018 the government will begin running a deficit—collecting less in SS taxes than it pays in benefits. Because the government does not save our Social Security taxes for future retirees, and since the fund is already "funded" through SIBs, there will be no "cash" in the fund to make up the difference. This is because Congress borrows this extra money FROM THE SSI FUND and uses it to make up for deficits elsewhere in the budget. Essentially the Social Security trust fund contains nothing but IOUs the government has written to itself.

The simple truth is this. The status of the SS Trust Fund depends entirely on the government's ability to sell SIB's to CONTINUE covering the recurring cost of the GROWING population of those receiving benefits. Should there be a reason for those buyers to question the credit worthiness of the SIB issuer (the U.S.) then they'll demand higher interest be paid by the government in return for purchase of the SIBs. This will cause significant issues on the governments balance sheet. Remember Debt-to-GDP is already over 100%, but it's Debt-to-Tax Revenue that we all should be concerned about.

And Debt-to-Tax Revenue is over 300% (this means the government OWES 300% more than it takes in in tax revenue)

When the buyers demand interest rates of return that cannot be met and SIBs can no longer be sold, SSI will not be funded.

This explains it further:

http://www.uschamber.com/issues/retirem ... -fund-myth